Insights

The stagflation challenge: how to future-proof liquidity risk

Cash is king. This may be a cliché, but it also happens to be true. If your balance sheet is bulging with greenbacks, it’s almost impossible to default. By…

Wealth Management: Is It Too Late for Early Warnings?

From politics to punchlines, timing can be everything. The same goes for investment. In an ideal world, wealth managers would have foreseen the declines we’ve seen on financial markets…

How to Manage Balance-Sheet Risk in Volatile Times

Markets tanking, rates rising, recession looming, Russia’s Ukraine invasion ongoing – these are, to put it mildly, volatile times. Against this backdrop, how should financial institutions manage balance-sheet risk?…

The Next Frontier in Risk Management: How to Achieve Digitalization

What do you do if you want to digitalize your risk management processes? For a start, firms need to take a top-down, big-picture approach that makes use of explainable…

IERM: How to Build a True Risk-Business Partnership

Some of us dream of Olympic glory. Others, of making it big by backing the next meme stock before it goes to the moon. For the past three decades…

Strategic Asset Allocation

What is Strategic Asset Allocation’s problem? It helps investment managers determine how best to spread their investments. But SAA can’t use standard mean-variance portfolio analysis. Adding a few standalone…

The pros & cons of Alternative Investments

Alternative investments are all the rage these days. But how do you select an investment strategy that optimally improves the risk/reward trade-off in your portfolio, while avoiding being overwhelmed…

The Uncertainty of Inflation Risk

Inflation is surging. But just how high will it go, and how long will it endure? The short answer is that no-one knows for sure. But while predicting the…

The Alternative Data Craze: Peering Behind the Curtain

To enhance returns, develop dynamic risk limits and beat competition, asset managers and hedge funds are increasingly turning to alternative data. But what’s driving the big demand for this…

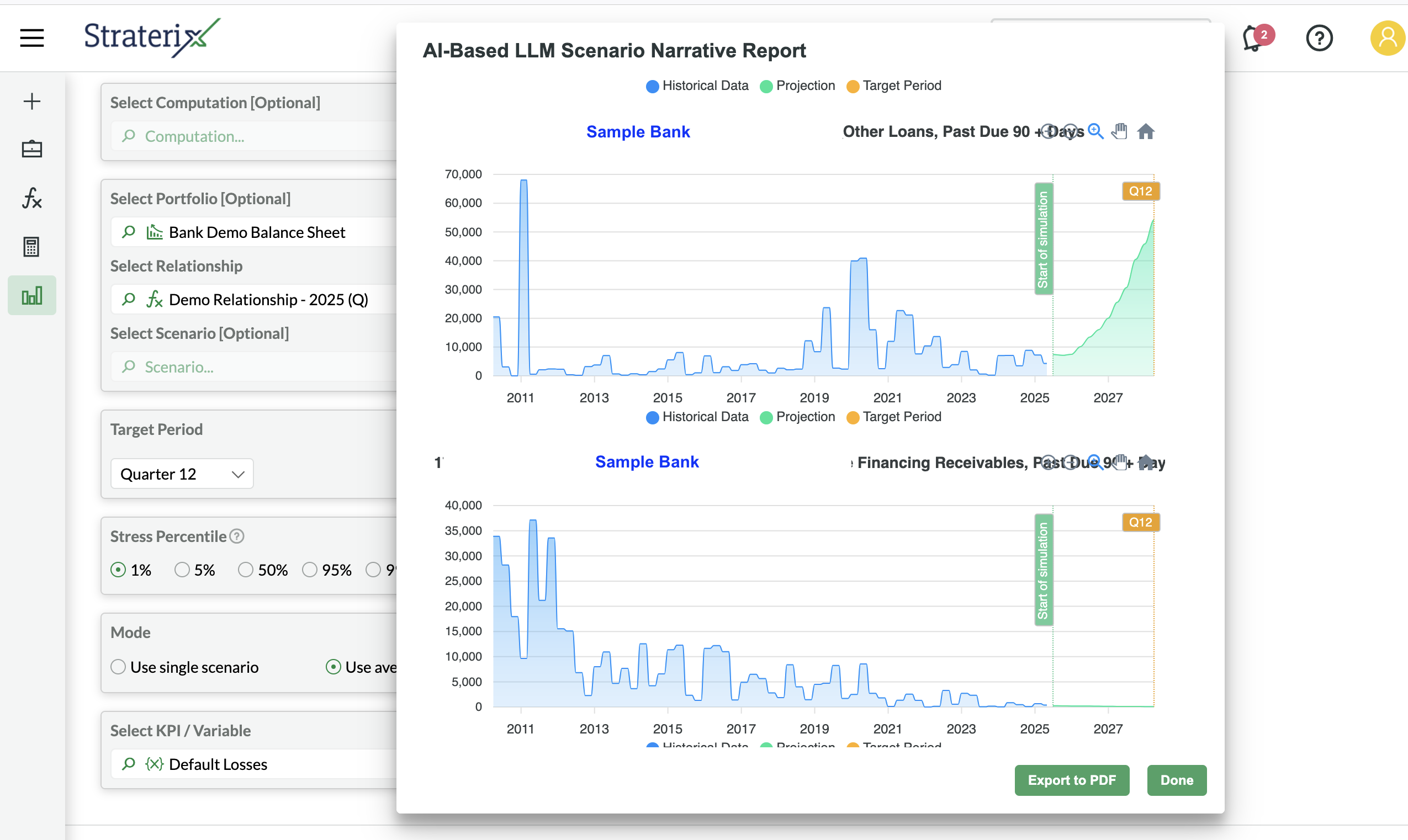

How effective are your Scenarios?

Many business functions use automatically generated scenarios for pricing, hedging, and meeting regulatory and accounting requirements. These scenarios are generated with certain probabilities: real, risk-neutral, and so-called market-consistent ones….

What’s Missing in Asset and Liability Management?

Quite a bit, as it happens. Traditional Asset & Liability Management (ALM) assumes deterministic levels of assets and liabilities and focuses on interest rate, currency, and liquidity risks. Ideally, it should…

How to Stress Test for Extremely Unexpected Scenarios

Like reality TV or Marmite, surprises aren’t to everyone’s taste. Sometimes they’re nasty (like the pandemic and the lockdowns it caused). Sometimes they’re nice (like the rapid market recovery…