Admin

Black Swans vs. A.I.

How is artificial intelligence changing the banking industry? Will bank analysts be replaced by A.I.? And is that a bad thing? A former Credit Suisse analyst and a veteran…

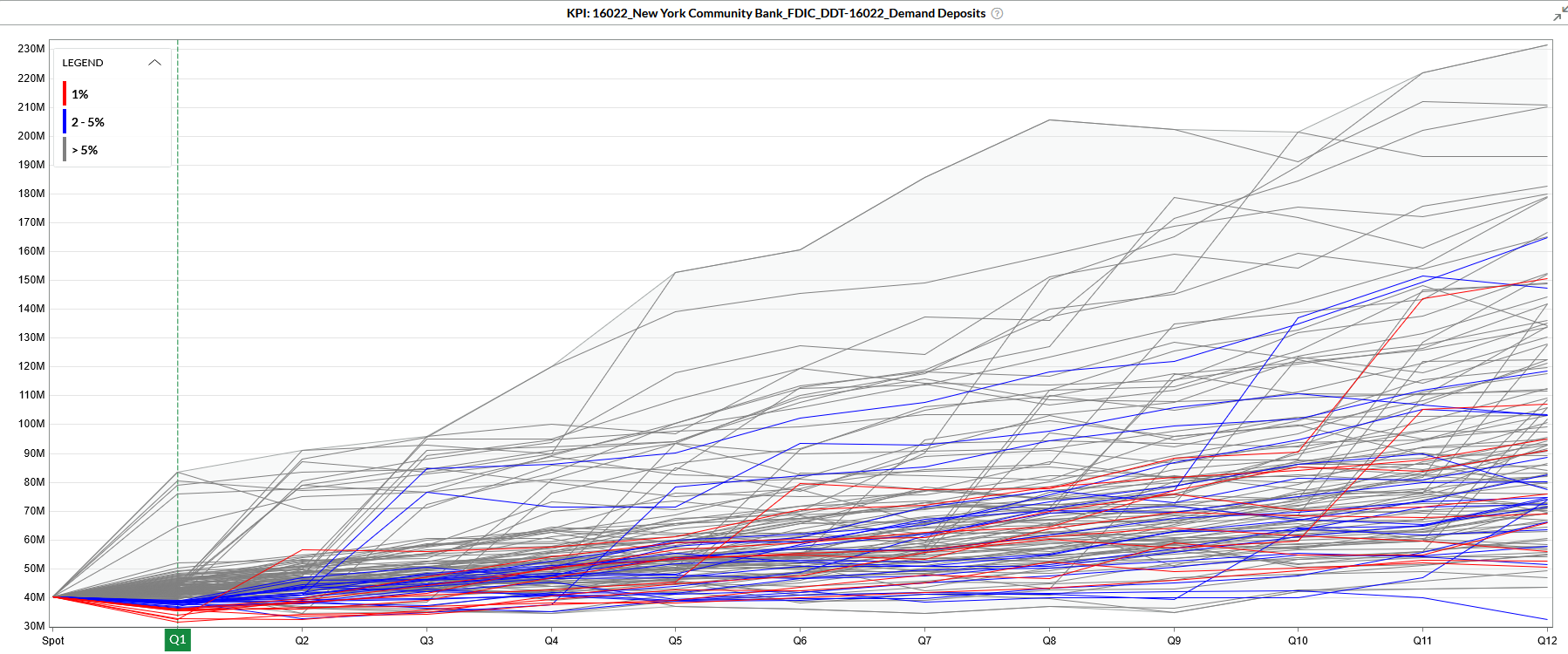

New York Community Bancorp – Is the $1B Capital Injection Enough?

A few weeks ago, New York Community Bancorp (NYCB) was downgraded to below investment grade status. The fears of a continuation of the regional banking crisis have been mounting….

Basel III Endgame and other sequels

It sounds like the title of an action-staved Marvel movie. Yet “Basel III Endgame” is still managing to set pulses racing – at least among regulators and bank risk…

Straterix Quarterly Newsletter

Important note: While Straterix is headquartered in the US, our R&D heart beats in Israel. Amid the ongoing turmoil, we extend our deepest condolences to those who lost their loved-ones,…

Shock preparation

From natural disasters to financial ones, regulators and governments are almost guaranteed to respond in some capacity. But whether it’s mothballing nuclear power stations, or mandating tougher capital requirements…

Exhaustive Scenario Analysis: What Risk Managers Can Learn From Pilots

What can CROs learn from airline pilots? Quite a bit. Pilots have to know how to take their plane to safety no matter what. In training, they need to…

The 3-step checklist for improving risk oversight at banks

It is, according to the FT’s U.S. Editor-at-large, Gillian Tett, one of the smartest ideas to emerge in finance for a long time”. The idea in question is “reverse…

How to Customize Stress Testing & Scenario Analysis

Henry Ford famously remarked that “a customer can have a car painted any color he wants as long as it’s black”. Whether the founder of the eponymous car-maker uttered…

How not to be the next SVB

“How did you go bankrupt?” Bill asked. “Two ways,” Mike said. “Gradually, then suddenly.”” These lines, from Ernest Hemingway’s The Sun Also Rises, could just as easily apply to…

Managing Liquidity Risk and Funding Costs During a Crisis

On HBO’s The Last of Us, much of humanity has been zombified by a fungus that spreads like, er, a virus? In economic crises, liquidity risk can do the same,…

After a challenging 2022, will this year be any better?

After three years of pandemics, bear markets and war, what on earth could 2023 have in store? Anyone who tells you they know the answer to that question is…

Next-Gen Strategic Asset Allocation (SAA) Platform

Bringing the power of machine learning and full-range scenario analysis to Strategic Asset Allocation, Straterix is the first SaaS application of its kind for CIOs and senior risk managers….